I am here to debunk the myth that travel is expensive. Can it be? Yes. I’m not going to sit here and sell you the pipe dream that all travel is dirt cheap, because it’s not. For example, if you’re a family of 5, then yeah, your travel expenses are going to be significantly more than, say, a solo traveler. But, that does not mean there aren’t ways to make travel affordable for you and your situation. I’ve shown you guys How to Save Hundreds Using Skyscanner and How to Snag an Airline Glitch Fare, but these posts are pointless if you don’t have the actual coinage to book these bad ass deals to begin with. Last time I checked, you can’t book with your good looks, so there has to be an alternative.

That’s where two of my favorite apps come in – Digit and Acorns!

For me, saving money is difficult. Let me take that back…conscious saving is difficult. What do I mean by that? If it requires me to go to a bank, stuff it in a shoe box, or even go into an app and click a couple of buttons to transfer to a separate account, chances are, it’s not gonna happen. The only saving method that works for me is if I don’t have to think about it. I set it and forget it. When I was working a 9-5, I had an amount deducted from my paycheck and sent to an account where I didn’t even have the bank card activated. Easy peasy.

Then, I discovered these two incredible money-saving apps that helps me save even more, without having to think about it. So, how does these apps work? Let’s get into it.

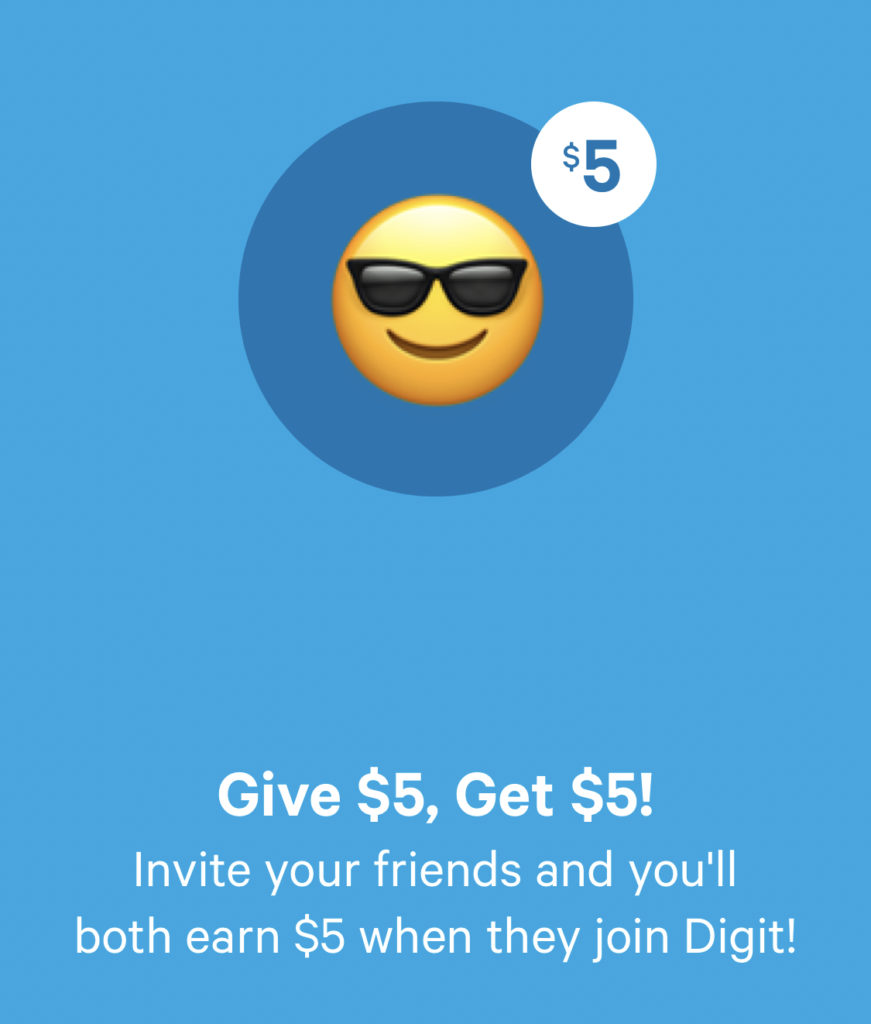

Digit

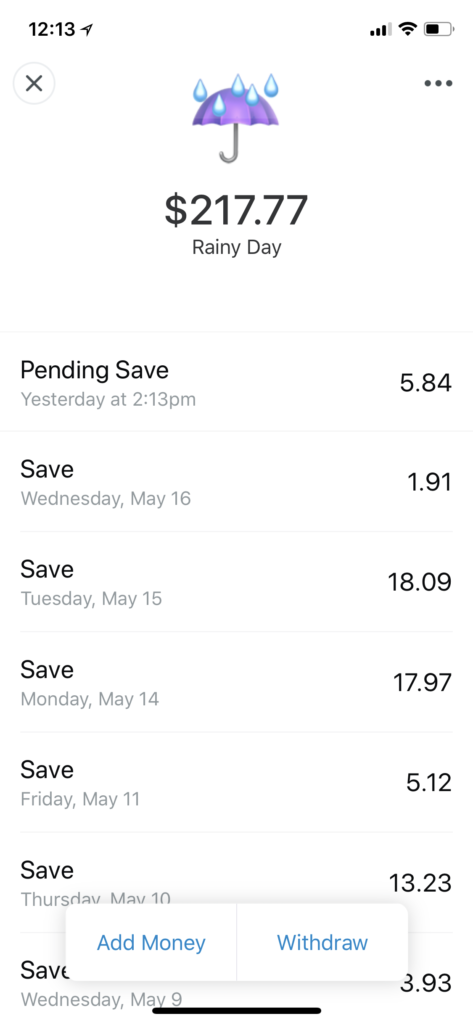

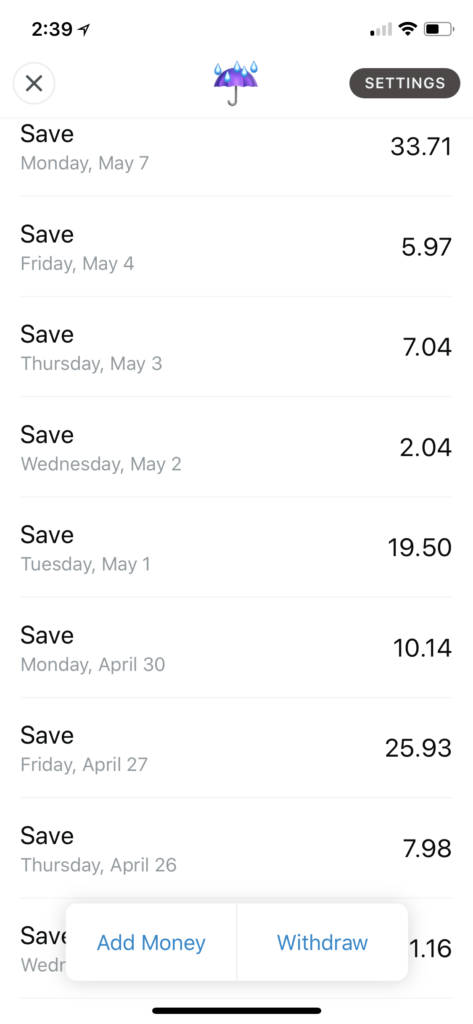

This app is my favorite of the two. You set up your account and it saves amounts in increments according to your spending habits and available balance. So, this means, one day it may save $2.04 and one day it may save $33.71. For instance, for me, around the first of the month, it would generally save less than it would mid-month, because I had payments such as rent and other bills coming out of my account around the beginning of the month. For you, the app may recognize that you buy that $7 Starbucks every Monday, Wednesday and Friday so on those days it will take out a little less, according to those spending habits.

The amount varies, but whether it’s a little or a lot, you’re saving without having to think about it. The app does all the thinking for you.

Take a look at some of my savings below:

What else I love about Digit:

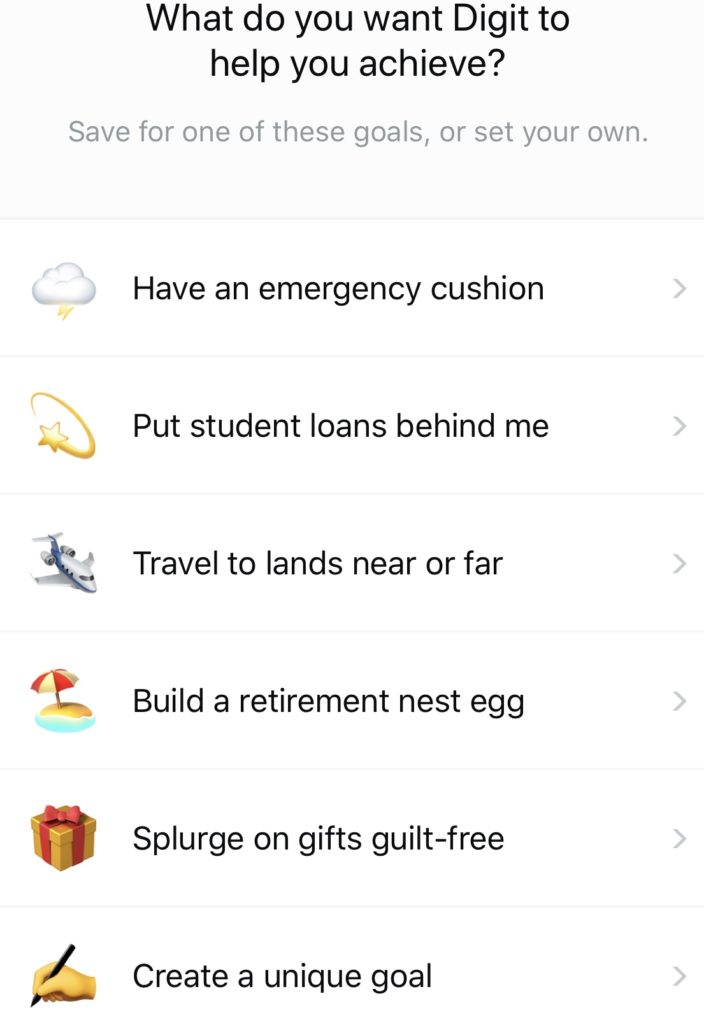

- You can add personal goals. Say you want to save up for an upcoming trip. You can select the amount you want to save and the date in which you want to save it by, and Digit will help you reach that goal.

- Digit will not save anything if you are at risk of overdrawing your account. The app is not going to send you into the negative by saving funds.

- It has a Low Balance Protection feature. If you fall below your desired account balance, the app will deposit money into back into your account to bring you back up to that balance.

*Note: Digit charges a $2.99 fee per month after the free trial has ended, but again, you don’t even miss it.

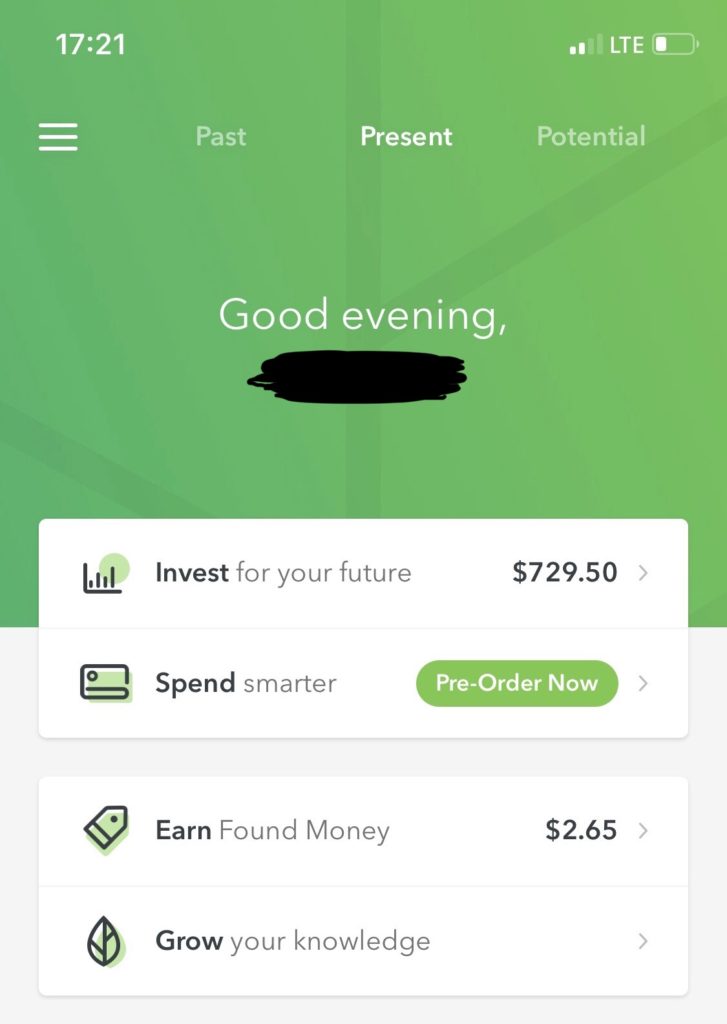

Acorns

One of my best friends actually told me about this app and I’m so thankful he did! It’s very similar to Digit in that it helps you save without thinking about it. One of the primary differences with Acorns is that it is a micro-investment account, which allows you to invest your spare change. Acorns round up your purchases to the nearest dollar and invests it in a stock portfolio. Don’t worry, you don’t have to be a stock guru to set this up. Trust me, if I can do it, anybody can. They have incredible resources and tips to help you decide what kind of investor you’d like to be, whether conservative or risky.

What else I love about Acorns:

- Set up a reoccurring amount to save. You can allot a specific amount to be invested on a monthly basis. This can be as little or as much as you’d like.

- Brands will invest in your future when you shop. Basically, when you shop with some of your favorite brands they will invest a percentage or dollar amount into your account. For example, sign up and host your first guest with Airbnb and earn $200. Earn 4% for booking on orbitz.com or $5 when booking on cheapoair.com.

- Tons of resources to help you with financial literacy. This isn’t just a regular shmegular money-saving app, it actually provides tools and resources on helping you invest in your future.

When your friends love the app just as much as you do:

Digit and Acorns are the best apps to save for travel. And trust me, I’ve tried lots of them. I have paid for entire trips with the funds I’ve saved with these two apps. So, whether you’re making a little or a lot, don’t let your wages keep you from living your best life. Thanks to these apps, saving for travel has never been easier.

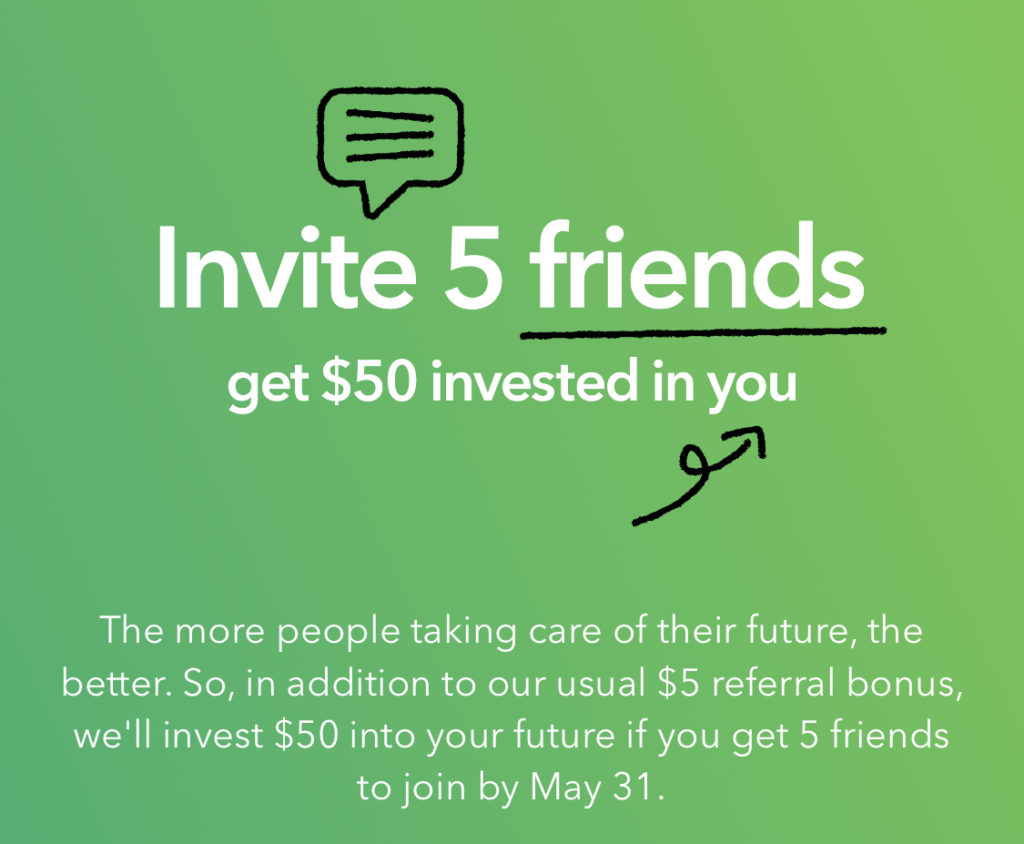

Go ahead. Download them using my referral link so you’ll receive $10. Start saving. Tell all your friends about them and earn even more coins to fund your travel fun!